The history of the Fundo de Garantia de Depósitos

The history of the Fundo de Garantia de Depósitos

The Fundo de Garantia de Depósitos was created in 1992 by Decree-Law No 298/92 of 31 December 1992, which approved the Legal Framework of Credit Institutions and Financial Companies.

However, the Fund did not start operating until 1994, after technical and organisational work triggered by the appointment of the first Management Committee of the Fund on 21 February 1994, by means of a Decision issued on that date by the then Minister for Finance, Eduardo de Almeida Catroga.

Over 25 years of history, the Fundo de Garantia de Depósitos has had four chairs – António Bagão Félix, António Manuel Marta, Pedro Duarte Neves and Luís Máximo dos Santos – and accumulated resources in excess of 1.5 billion euros, having been called on once, in April 2010, to reimburse the deposits made with Banco Privado Português, S.A., currently being wound up.

The logo used between 1994 and 2018 (at the bottom) and some alternatives considered in 1994

The first Management Committee was chaired by António Bagão Félix, also Vice-Governor of Banco de Portugal at the time. Its other members were José Manuel Neves Adelino and Rui Jorge Martins dos Santos. They were assisted by Mário Remédio as Secretary-General appointed by the Management Committee in April 1994.

The first meeting of the Management Committee took place on 11 March 1994.

“The Management Committee’s first meetings defined the tasks to be carried out to set up and operate the Fund and appraised various technical studies and documents drawn up for that purpose, which are hereto attached. These documents particularly regard the choices concerning the Fund’s funding mechanism, setting the amount of the member credit institutions’ initial and periodical contributions and the manner in which they are to be paid, how to invest the Fund’s assets, the arrangements for members to join and cease to be a member of the Fund, the conditions for the repayment of deposits in the event of failure of the credit institution and liaison with the Banco de Portugal’s potential intervention, through extraordinary reorganisation and recovery measures.”

Extract of the first minutes of the Fund’s Management Committee, 14 June 1994

Also in 1994 following António Bagão Félix’s resignation as Vice-Governor of the Banco de Portugal, António Manuel Marta, his replacement as Vice-Governor, became Chair of the Management Committee in June of that year.

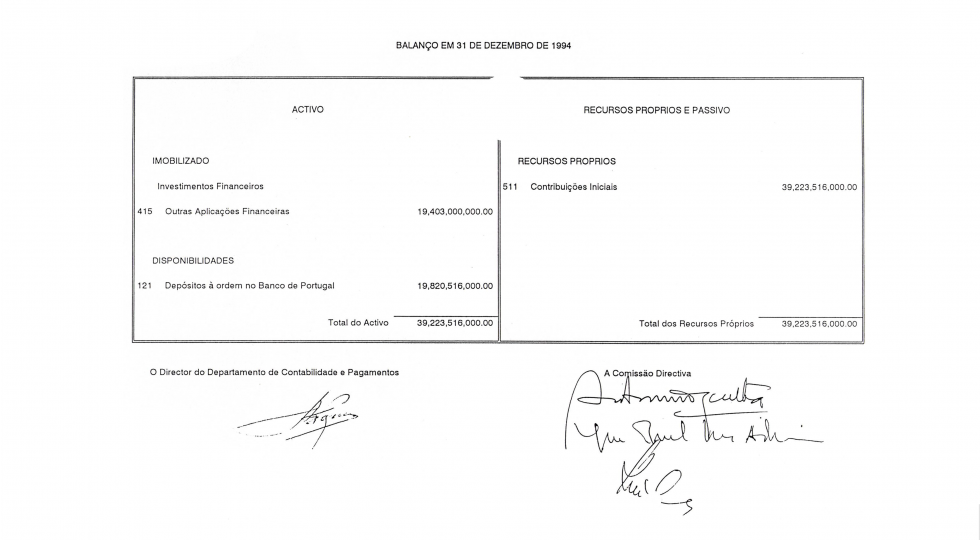

The Fund’s balance sheet at the end of its first year recorded total assets of 39 223 516 000 PTE (approximately 196 million euros), invested in deposit securities named Títulos de Depósito – Série A and Títulos de Depósito – Série B, issued by the Banco de Portugal and in sight deposits with the Banco de Portugal.

These assets consisted of the initial contributions paid by the member credit institutions of the Fund at the time, and of an initial contribution paid by the Banco de Portugal.

The first balance sheet of the Fundo de Garantia de Depósitos

List of member credit institutions at the end of the first year of activity

BANKS

- Caixa Geral de Depósitos, S.A.

- ABN Amro Bank, NV

- Banco Bilbao Viscaya (Portugal), S.A.

- Banco Borges & Irmão, S.A.

- Banco Chemical (Portugal), S.A.

- Banco Comercial de Macau, S.A.

- Banco Comercial dos Açores, E.P.

- Banco Comercial Português, S.A.

- Banco de Fomento e Exterior, S.A.

- Banco de Investimento Imobiliário, S.A.

- Banco do Brasil, S.A.

- Banco Efisa, S.A.

- Banco Espírito Santo e Comercial de Lisboa, S.A.

- Banco Essi, S.A.

- Banco Exterior de España, S.A.

- Banco Finantia, S.A.

- Banco Fonsecas & Burnay, S.A.

- Banco Internacional de Crédito, S.A.

- Banco ltaú Europa, S.A.

- Banco Mello, S.A.

- Banco Nacional de Investimento, S.A.

- Banco Nacional Ultramarino, S.A.

- Banco Pinto & Sotto Mayor, S.A.

- Banco Português do Atlântico, S.A.

- Banco Sabadell, S.A.

- Banco Totta & Açores, S.A.

- BANIF - Banco Internacional do Funchal, S.A.

- BCI - Banco de Comércio e Indústria, SA.

- BNC - Banco Nacional de Crédito Imobiliário, S.A.

- BPI - Banco Português de Investimento, S.A.

- BPN - Banco Português de Negócios, S.A.

- Barclays Bank Plc

- BSN - Banco Santander de Negócios Portugal, S.A.

- CISF - Banco de Investimento, S.A.

- Citibank Portugal, S.A.

- Companhia Geral de Crédito Predial Português, S.A.

- Credibanco - Banco de Crédito Pessoal, S.A.

- Crédit Lyonnais Portugal, S.A.

- Deutsche Bank de Investimento, S.A.

- Finibanco, S.A.

- The Bank of Tokyo, Ltd.

- União de Bancos Portugueses, S.A.

SAVINGS BANKS

- Caixa Económica Comercial e Industrial anexa ao Montepio Comercial e Industrial

- Caixa Económica da Associação de Socorros Mútuos de Empregados no Comércio de Lisboa

- Caixa Económica da Guarda

- Caixa Económica da Misericórdia de Angra do Heroísmo

- Caixa Económica da Misericórdia de Ponta Delgada

- Caixa Económica do Porto

- Caixa Económica Montepio Geral

- Caixa Económica Social

MUTUAL AGRICULTURAL CREDIT BANKS (*)

- Caixa de Crédito Agrícola Mútuo do Bombarral

- Caixa de Crédito Agrícola Mútuo da Chamusca

- Caixa de Crédito Agrícola Mútuo de Mortágua

- Caixa de Crédito Agrícola Mútuo de Vila Franca de Xira

(*) Not belonging to the Integrated Mutual Agricultural Credit Scheme.

After 1994 the Management Committee remained unchanged for nine years until Rui Martins dos Santos passed away in April 2003. At that time, António Vieira Águas was the Secretary-General and had been since January 2001.

“After the meeting was opened, the Management Committee expressed its condolences for the death of Rui Martins dos Santos on 15 April 2003, stating its appreciation for the diligent and vigorous way he had participated in the Fund’s management and for his great personal commitment, which, from the start and over eight years, helped build an institution that plays an important role in the Portuguese banking system.”

Extract of the minutes of the meeting of the Fund’s Management Committee held on 9 May 2003

The post left vacant by Rui Martins dos Santos was occupied from April 2004, and for approximately 12 years, by João Salgueiro, appointed by the Associação Portuguesa de Bancos (APB – Portuguese Banking Association).

In May of the same year a Decision of the then Minister of State and Finance, Maria Manuela Ferreira Leite, appointed António Amaro de Matos to take over from José Neves Adelino.

In 2006 António Manuel Marta left the Fund and Pedro Duarte Neves, also Vice-Governor of the Banco de Portugal, became chair.

While Pedro Duarte Neves was chair, António Amaro de Matos ceased his functions and a Decision of the then Secretary of State for the Treasury and Finance, Carlos Costa Pina, replaced him with Carlos Manuel Durães da Conceição as of May 2008.

The first and so far the only call on the guarantee provided by the Fund occurred in April 2010 during the term of office of Pedro Duarte Neves, Carlos Durães da Conceição and João Salgueiro, the members of the Management Committee until 2016, who were assisted by João Filipe Freitas, as Secretary-General from October 2010 onwards (learn more).

Following the end of João Salgueiro’s term of office, Maria Manuela Athayde Marques was appointed to the Management Committee in June 2016 by the APB.

The current Chair of the Management Committee, Luís Máximo dos Santos, was appointed in July 2016 by the Banco de Portugal, where he is currently Vice-Governor.

Following the termination of the term of office of Maria Manuela Athayde Marques in December 2018, Ana Catarina de Carvalho Gaspar Cardoso Resende Gomes was appointed member of the Management Committee by the APB in January 2019.

On 1 January 2020, Decree-Law No 106/2019 of 12 August 2019 entered into force, it transferred the deposit guarantee function from the Fundo de Garantia do Crédito Agrícola Mútuo to the Fundo de Garantia de Depósitos, which meant that the latter became the only deposit guarantee scheme in Portugal.

Notwithstanding the fact that the number of member credit institutions of the Fund more than tripled at once, the Fund’s ability to guarantee the repayment of deposits made with its member credit institutions was not affected since, under that law, the liability of guaranteeing the deposits made with the Central Mutual Agricultural Credit Bank and its associate agricultural banks was transferred with the required financial resources, in a manner that ensures the Fund’s financial soundness.

Following the termination of the term of office of Ana Catarina de Carvalho Gaspar Cardoso Resende Gomes, Norberto Emílio Sequeira Rosa was appointed to the Management Committee in Februrary 2022 by the APB.

Current Management Committee

Chair: Luís Augusto Máximo dos Santos – Appointed by the Board of Directors of the Banco de Portugal

Members

- Carlos Manuel Durães da Conceição – Appointed by the Secretary of State for the Treasury and Finance, exercising duly delegated powers.

- Norberto Emílio Sequeira Rosa – Appointed by Associação Portuguesa de Bancos (APB - Portuguese Banking Association).

Secretary-General: João Filipe Soares da Silva Freitas